The simple way to comply with AML & KYC

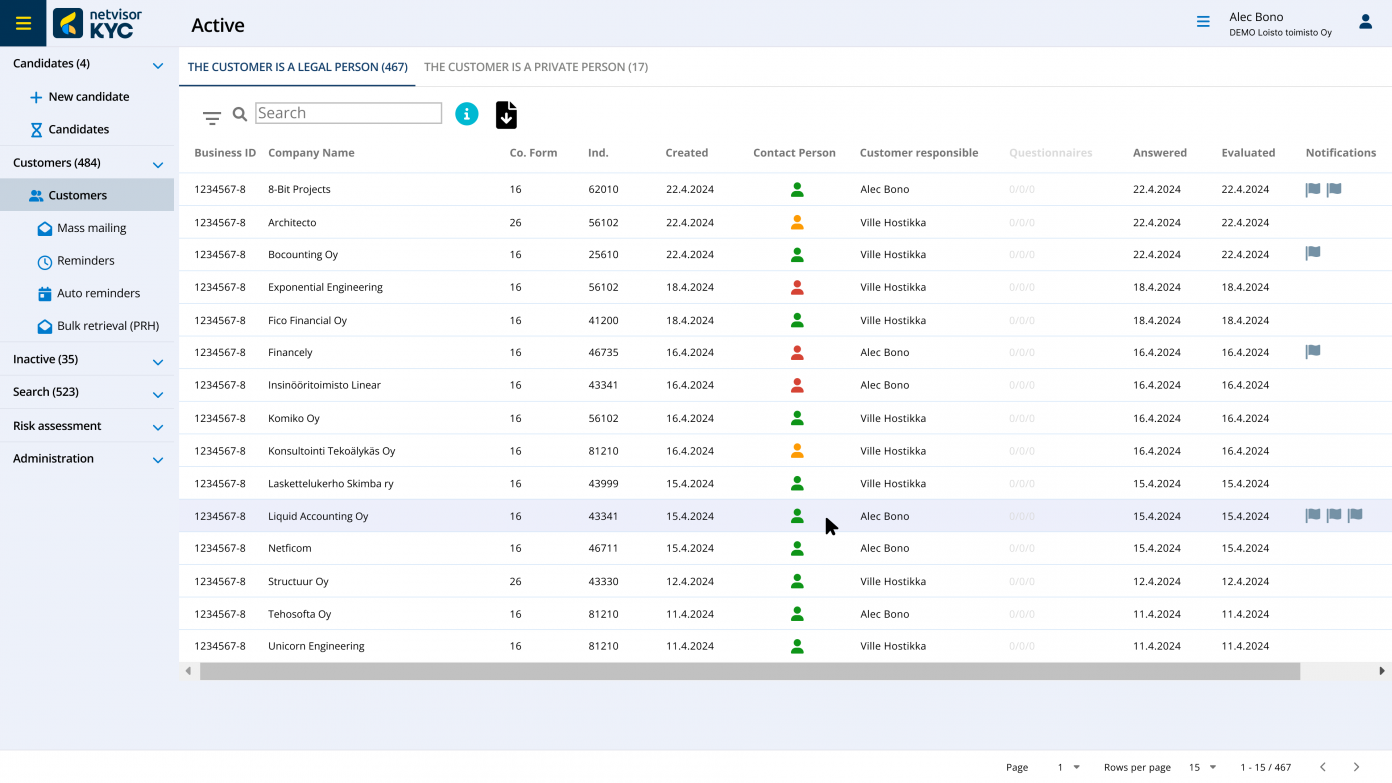

Automate your KYC process with an all-in-one solution

Netvisor KYC saves time in collecting required customer information, staying on top of sanction lists, managing risk assessments, and more.

100 000 +

identified customers

+10 000

sent information request per month

96%

customer satisfaction (csat)

of users recommend the tool

Manage KYC obligations without worrying

With Netvisor KYC, you save time and fulfill KYC obligations easily alongside your main work

Leave your KYC worries behind

Spend more time on productive customer work by making KYC & AML requirements feel like a walk in the park.

Keep your customers satisfied

Manual KYC process also consumes your customers’ time. Netvisor KYC streamlines the submission of customer information and ensures that sensitive identification data is processed and stored securely in accordance with the law.

Identify and manage risks

Don’t fret unnecessarily about a visit from the authorities. Netvisor KYC helps you avoid costly sanctions and unpleasant damage to your reputation. The service continuously monitors updating registries on your behalf. Built-in risk assessment alerts you to detected deviations and helps you respond at the right time, in the right way

We are here to help you

In addition to the service, you will have the assistance of the best experts in the field. We inform you about changes to the anti-money laundering law and help you understand your obligations without the complexities of the law. Our high customer satisfaction and quick response times ensure that you get help whenever you need it.

Why Netvisor KYC?

Make compliance with the Anti-Money Laundering legislation and KYC requirements easier than you thought they could be.

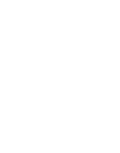

Fast and reliable registry searches

Comprehensive registry searches significantly simplify the process of background checks for your clients.

Instead of manually entering data, you retrieve the company’s key personnel, owners, and ultimate beneficiaries from public registers within seconds. Automatically updated information reduces unnecessary steps and facilitates data analysis throughout the entire customer relationship.

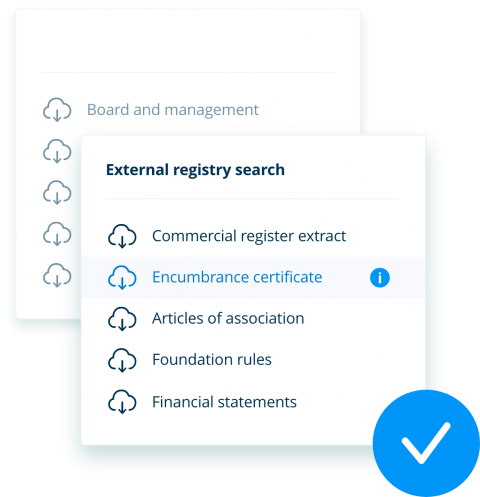

Automated sanctions and watchlist checks

Netvisor KYC automatically identifies your clients’ PEP information and checks them against sanctions lists at regular intervals. The system monitors updated lists on your behalf. You will be notified immediately of any changes in the information

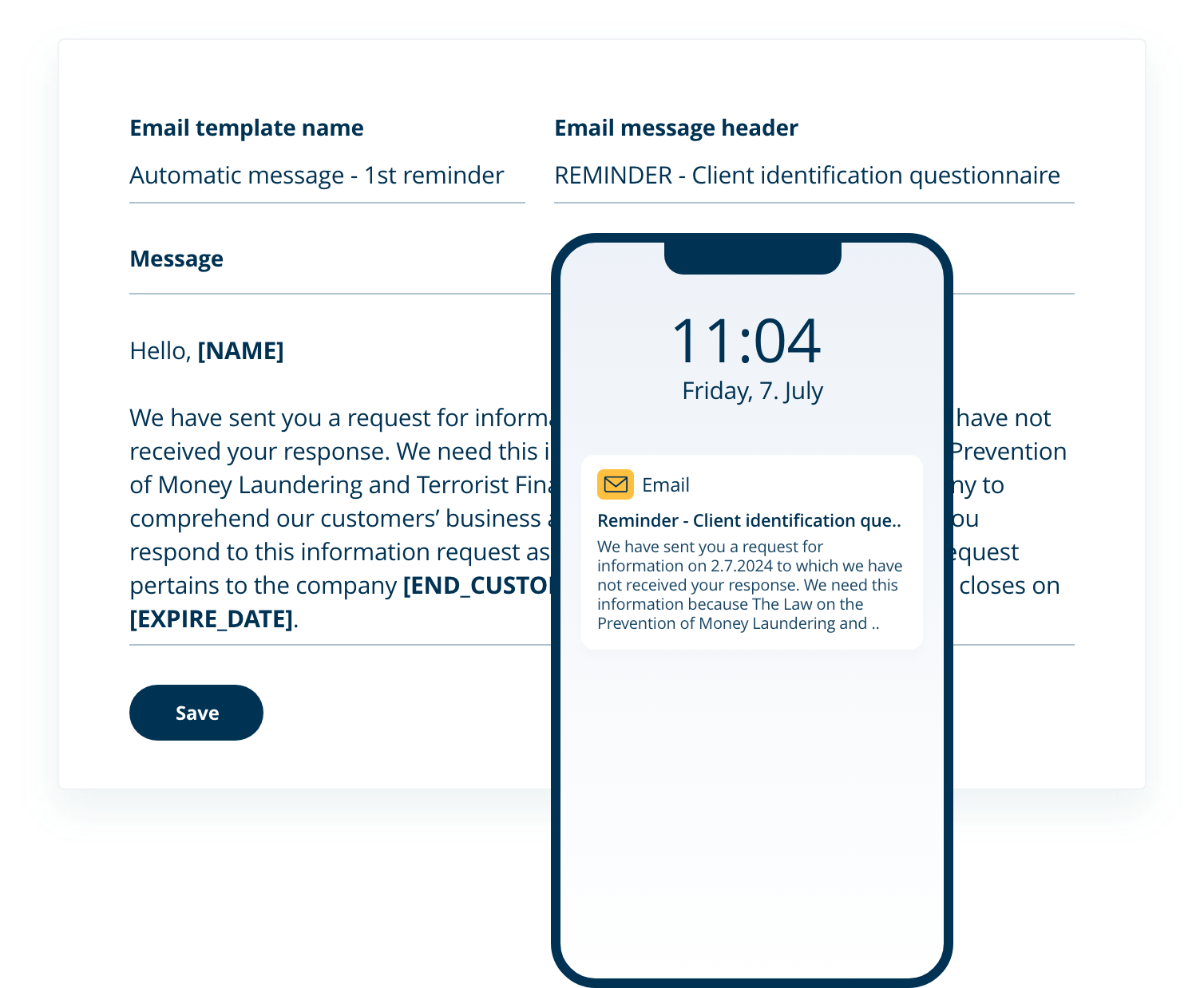

Automatic reminders

Monitor the KYC process in real-time and keep it on schedule with automatic reminders. Automatically scheduled reminders expedite the processing of identification data and significantly reduce the time spent on the KYC process.

Assisted risk assessment

With Netvisor KYC, you can easily build a proactive and risk-based operating model for your company.

The system provides all necessary information and assists you in creating and maintaining both your own and client-specific risk assessments.

Electronic Identity Verification

Fulfill the legal requirements for customer identity verification with strong authentication or mobile certificate. The identity of your foreign customers is verified using a reliable biometric identification method.

Convenient Bulk Action

Save time and enhance your KYC process by handling multiple customers simultaneously. The service’s bulk action feature allows you to retrieve company basic information, send information requests, and conduct sanction and watchlist checks for large numbers of customers easily all at once.

Electronic Information Request Forms

The service includes pre-designed information request forms suitable for all customer types. If your company has special needs, they are accommodated with customized individual requests.

Information Always Securely Stored

Special attention has been paid to the security of the service, which meets Visma’s high security standards. Information between the customer and the obligor moves through secure connections. KYC information is always safely stored separate from other customer data.

Comprehensive Integrations

Minimise unnecessary work and overlapping systems. Easily connect Netvisor KYC to your existing financial management, ERP, or CRM systems through an interface.

Generic link

Collect KYC information effortlessly with a generic link. Send your customer a link, and the customer will log into the information request with strong authentication and enter the information directly into the system. You don’t need to create pre-made forms or pre-fill requests – the customer does everything themselves.

The most comprehensive KYC process on the market

Collect KYC-information in only minutes

1.

Information Request Preparation

Easily prepare and pre-fill information requests by automatically retrieving a company’s basic information through registry searches.

Netvisor KYC checks your client and their stakeholders against real-time sanctions and watchlists with just a few clicks.

After the checks, the information request is sent to the client to complete the due diligence information.

2.

Authentication and Filling Out the Information Request:

The client verifies their identity using strong authentication or a mobile certificate and responds to industry-specific, statutory questions.

Upon completing the responses, the filled-out information request is sent back to the sender.

3.

Risk Assessment and Continuous Monitoring

Netvisor KYC aids in the analysis of information requests and in determining the risk level of a client. The client’s due diligence information is securely stored and archived in the system.

With customer-specific risk assessments and regularly updated external registry information, you receive immediate alerts about changes in due diligence information.

This allows you to focus your monitoring efforts on customers with a higher risk basis and let automation handle the monitoring of low-risk clients

An effortless and ready solution for every AML obligated entity

Netvisor KYC is designed to meet the needs of every obligated entity, regardless of industry or company size. Our clients from dozens of different industries have created straightforward, secure, efficient, and documented KYC processes smoothly with the help of Netvisor KYC.

Accounting and Auditing

Netvisor KYC helps automate your customer due diligence and ensures an effective KYC process. The service’s predefined information requests and automatic sanctions list checks assist accountants and auditors in collecting KYC information quickly and easily without the need for pen and paper.

Investment and Financial Services

Enhance trust in your buseiness’s risk management. Netvisor KYC makes KYC-process easy, reduces the workload on your employees, and ensures a smooth KYC process from your customers’ perspective as well.

Law Firms and Legal Services

Law firms and legal services handle assignments with various risk profiles within individual client accounts. Netvisor KYC enables the drafting of assignment-specific risk assessments, allowing all levels of risks to be documented on an assignment-by-assignment basis. Additionally, the service facilitates the easy search of business information from international registries as well.

Real Estate Agents

Only half of the companies in the real estate sector comply with the statutory requirements of the anti-money laundering legislation impeccably. Up to three out of four report identifying their customers personally using an identity document (nSight 2023). Netvisor KYC speeds up the collection of due diligence information and makes the KYC process smoother from the client’s perspective as well.

Property Management

Customer due diligence is a key part of property management, but nearly half of the real estate sector companies find complying with anti-money laundering legislation challenging and time-consuming (nSight 2023). Netvisor KYC eases the workload of property managers by identifying PEP individuals in the housing company’s board and performing the required sanctions list checks. Customer due diligence is completed in just a few minutes, and all necessary information is stored in one place, easily accessible.

Product demo

Curious to see how it all really works?

See our product demo showcasing the essential elements of Netvisor KYC.

Netvisor KYC pricing

Choose your package

Replace messy spreadsheets and processes with one powerful KYC tool – fit for all businesses obligated by the AML legislation.

Select the number of customers to see the monthly price

Recommended

Defender

All necessary to get started. A suitable basic package for small businesses and organizations.

21€ / mo

VAT 0 %

+ transaction costsPackage includes:

- One user

- Electronic identity verification

- Pre-populated forms

- Data retrieval from public registers

- Automatic sanction list checks

- Send forms to multiple recipients at once

- Risk assessment tool

- Secure storage of identity information and deletion in compliance with GDPR

Recommended

Expert

An efficient and automated Know Your Customer -solution suitable for businesses across most industries.

51€ / mo

VAT 0 %

+ transaction costsIncludes Defender features +

- Three users

- Free Trade register extract

- Tax debt information

- Finnish Patent and Registration Office announcements

- Automatic reminders

- Electronic signature

- Integration with Netvisor

- Integration with ValueFrame

- Integration with Koho

Recommended

Genius

A comprehensive version for businesses looking to automate the KYC process for large numbers of customers.

101€ / mo

VAT 0 %

+ transaction costsExpert features +

- Unlimited number of users

- Generic link

- APIs to integrations

- Enterprise group management

- Automatic approval of forms

- Automatic risk classification

- Customised forms*

- Send forms from a chosen email address

- Azure AD login

- Customer classification by business area

*A customized information request is created according to the client’s instructions at the prevailing hourly rate.

Success stories

They trust in Netvisor KYC

Netvisor KYC is undoubtedly an investment that has paid off. The system automates workflows, retrieves data from various sources, reminds of checkpoints or data deletions, minimizes human errors, and saves time. Building a similar system in-house would be very costly.

Veli-Matti Ollikainen, Rotio

As laws change and technology evolves constantly, we need to continually educate our customers. It is crucial that Netvisor KYC can provide such added value to the customer.

Petri Lehmuskoski, Gorilla Capital

I feel secure knowing that customer due diligence is well managed. The data is stored in one place, handled correctly, and everything is documented as it should be.

Mika Hanni, Laskukauppa.com

Tired of AML mess? We are here for you

Switch to a carefree way of handling KYC requirements and never look back.